How to Reply GSTR 3A Notice: Penalties, Deadlines & Compliance

- 15 Sep 25

- 10 mins

How to Reply GSTR 3A Notice: Penalties, Deadlines & Compliance

- What is GSTR-3A?

- How Much Penalty Do You Need to Pay After Receiving the GSTR-3A Notice?

- What Happens if a Taxpayer Still Does not File Their Returns After the Notice?

- Which Non-filings of GST Returns Can Cost You a GSTR-3A Notice?

- What Should You Do When You Receive a GSTR-3A Notice?

- The Importance of Return Filing With the Help of an Example

- Tips To Handle GSTR-3A Notices Efficiently

- Conclusion

Key Takeaways

- GSTR-3A is not a return but a GST notice issued when taxpayers miss filing mandatory GST returns like GSTR-3B.

- Timely compliance avoids heavy penalties, as taxpayers must file pending returns within 15 days of receiving the notice.

- Late filing attracts interest at 18% p.a. and daily late fees, increasing business costs significantly.

- Ignoring GSTR-3A can trigger best judgment assessment under Section 62, leading to penalties of ₹10,000 or 10% of tax due.

- Automating GST return filing with accounting software helps businesses stay compliant and avoid costly delays.

A common problem that GST-registered entities face in India is complying with GST rules and regulations and filing their GST returns within the due date without fail. Many business owners fail to file their returns on time or even forget to file them. In such cases, they might be introduced to Form GSTR-3A.

Form GSTR-3A is an important part of India’s taxation system that plays a big role in maintaining tax compliance and motivating taxpayers to file their unfiled GST returns. Further in this blog, we are going to understand what a GSTR-3A notice means and how to reply to a GSTR-3A notice.

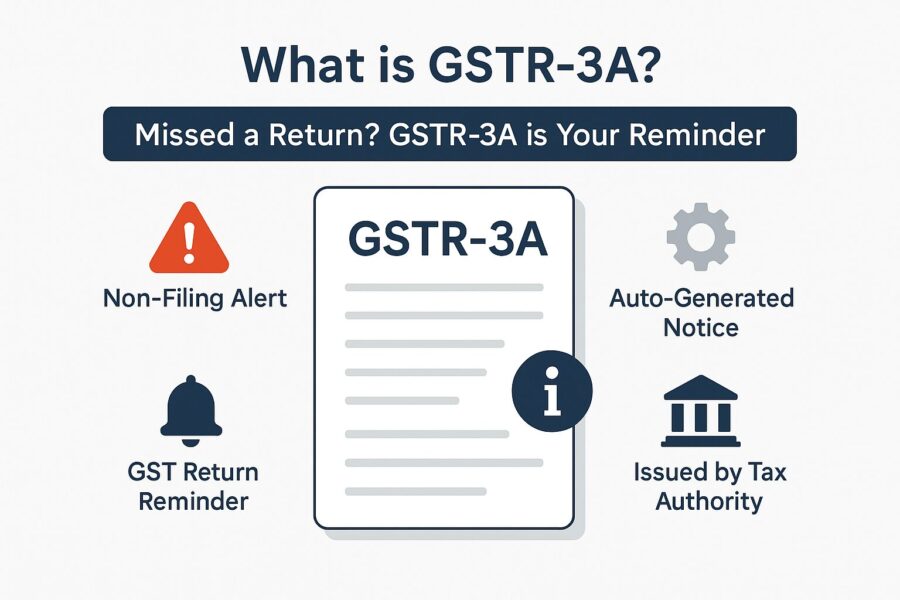

What is GSTR-3A?

Most people, when they read Form GSTR-3A, think this is a return form, but it is not. GSTR-3A is a notice that the government sends to GST-registered taxpayers who fail to file a return in Form GSTR-3B or any other GST return within the due date. Moreover, people should take their GST notices seriously, as ignoring it can lead to heavier fines and other severe actions.

These GST notices reminds GST taxpayers of their failed return filings with past due dates and notifies them to file their pending returns within 15 days of receiving the Form GSTR-3A notice, along with applicable fines and penalties. Mostly, this notice emphasizes the filing of the missed return, Form GSTR-3B.

How Much Penalty Do You Need to Pay After Receiving the GSTR-3A Notice?

The government charges two types of penalties for not filing returns before receiving a GSTR-3A notice, interest and late fees. Here is a summary of what you might have to pay:

- Interest

A taxpayer has to pay interest at 18% p.a., starting from the next day after the due date until the date of payment. The interest is calculated on the outstanding tax amount.

- Late Fees

For an annual return, the nominal late fee is ₹200. However, the maximum late fee can go up to 0.25% of the taxpayer’s turnover in that state.

For monthly or quarterly returns, the late fee is ₹100 per day per Act (CGST and SGST), which totals ₹200 per day. IGST does not attract a late fee. The maximum late fee for monthly or quarterly returns can go up to ₹5,000.

What Happens if a Taxpayer Still Does not File Their Returns After the Notice?

If a taxpayer still fails to file returns and does not pay taxes within 15 days of receiving the GSTR-3A notice, Section 62 of the CGST Act will apply. According to this section, a proper officer or tax authority will assess the taxpayer’s liability using their best judgment, based on available data.

The government will not issue any further notice before initiating proceedings. Once the officer assesses the tax liability, a penalty of ₹10,000 or 10% of the due taxable amount, whichever is higher, will be imposed.

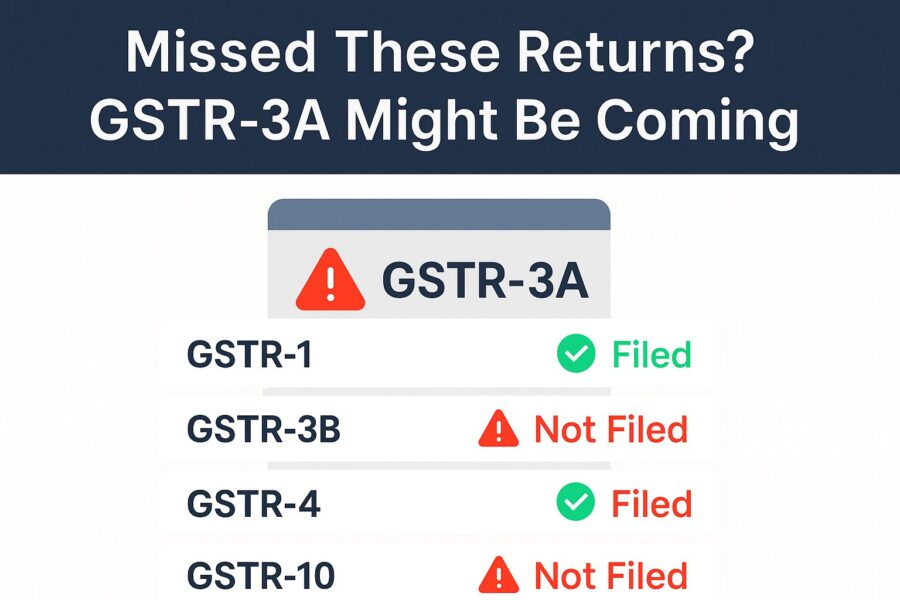

Which Non-filings of GST Returns Can Cost You a GSTR-3A Notice?

The Government issues a Form GSTR-3A notice to taxpayers who failed to file their GSTR-3B return and various other returns within due time or did not file them at all. Here is a list of the various types of GST returns for which people receive GST notices if they do not file them.

- GSTR-3B: This return is made by regular taxpayers registered under GST. It is a simple summary return where taxpayers declare a summary of their GST liabilities for a particular tax period.

- GSTR-4: The GSTR-4 is an annual GST return filing for GST-registered taxpayers. It applies to taxpayers who opted for a composition scheme during a financial year or any person who was once under the composition scheme after 1st April 2019.

- GSTR-5: All non-resident individuals who have a GST registration have to file a return as a statement or document of their business in India. They have to present these returns for a period as long as they carry out business transactions in India.

- GSTR-6: Some organisations that also represent as ISDs or Input Service Distributors have to file the GSTR-6 return every month. This return helps to distribute ITC or Input Tax Credits among its units. This return file contains details of all documents regarding the distribution of Input Credits and the way they distribute credit among these units.

- GSTR-7: People who deduct TDS under GST have to file GSTR-7.They must file their GSTR-7 by the 10th day of next month. This return filing contains important details such as TDS deducted and payable. It also contains details of the TDS refund.

- GSTR-8: People who run an e-commerce business, generally have to have a GST registration. This means they have to file GST returns. One of the returns they file is form GSTR-8, which is a statement of TCS made, or Tax Collection at Source.

- GSTR-9: The GSTR-9 is a return that regular taxpayers, including SEZ units and SEZ developers, file once every year. Taxpayers provide a lot of details in this firm, including operational details, Input Tax Credits and refund claimed, etc.

- GSTR-10: This return filing is just a one-time thing. Individuals file it only once when they decide to cancel their GST registration, or if they intend to shut down their entire business.

What Should You Do When You Receive a GSTR-3A Notice?

Once you receive a GSTR-3A notice. You will have to file your pending returns and pay your necessary penalties within 15 days of receiving your notice. This is the only way for you to be GST-compliant once again and avoid further penalties. Here are some steps you should follow to know how to reply to a GSTR 3A notice.

- Check our GST Profile

Before panicking, visit the GST Portal and log in with your credentials. Once you are in, check your overdue returns and get a clear understanding of which returns are pending to file.

- File Your Overdue Returns

File all of the returns that call for a GSTR-3A notice when not filed. Make sure to file all missing returns within 15 days of receiving your GST notices.

- Pay Your Taxes and Additional Penalties and Interest

Once you file your pending returns, you will have to clear your due taxes. Along with that, you will have to pay interest and a late penalty for not filing your returns on time. You can directly pay your taxes and any other remaining payments directly through the GST portal.

- Avoid Future Breach of Compliance

Many businesses use automatic billing and accounting software to file their returns. This helps them to avoid missing deadlines for returns filing in future. It also helps to avoid mistakes and saves your precious time towardsGST and direct tax compliance.

The Importance of Return Filing With the Help of an Example

Here is a story of Rekha from Hyderabad. She was GST-registered as her business was growing well. However, due to being busy, she unintentionally missed filing her GSTR-3B returns for two consecutive months. One day, she received a GSTR-3A notice.

Upon learning how to reply to a GSTR-3A notice, she filed all pending returns within 15 days. However, the accumulated late fees and interest cost her more than the benefit of the delay. Since then, she has never missed a deadline.

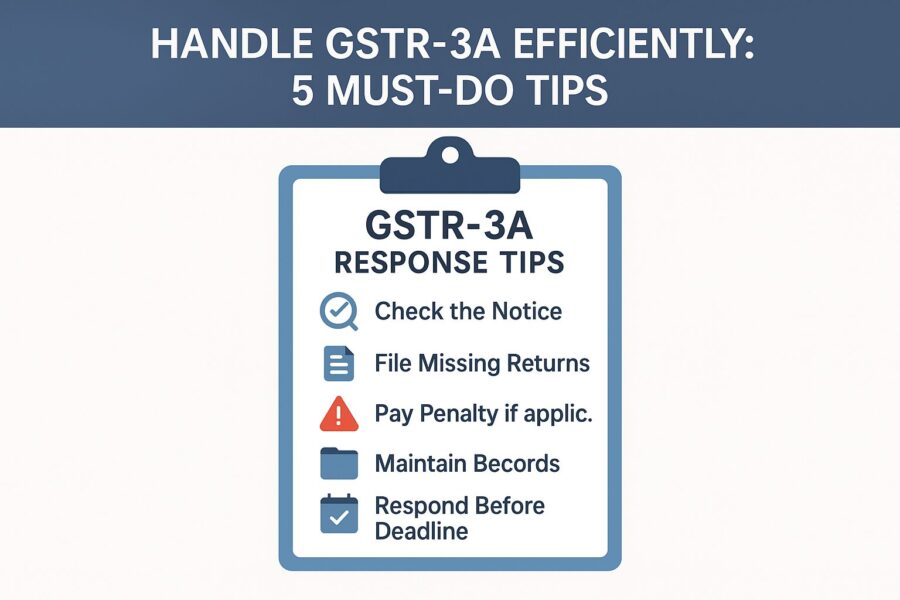

Tips To Handle GSTR-3A Notices Efficiently

You must be wondering how large businesses manage their operations, as well as do not miss a single deadline for GST return filings. Well, here are some tips from these businesspeople for you to follow and do the same.

- Use Accounting and Billing Software

Always keep up with technological advancements and make use of them to ease your work. Businesses use automatic accounting and billing software to automate most of their work and reduce their efforts in filing.

- Be Mindful

Make it a part of your routine to check your pending return filings and their deadlines once in a while. This will help you keep track of your position. You can also hire a professional service to handle your return filings.

- Understand The Gravity of Penalties

People often make the mistake of focusing on their business and do not file their GST returns. However, the penalties and interests can exponentially increase your business costs and push you towards bankruptcy. File your returns duly and avoid penalties.

Conclusion

Many people still do not know how to reply to a GSTR-3A notice, and often panic when they receive such a notice, they just do not understand what to do next. Well, it is not that big a problem until you make your return filings and pay your taxes and fines within 15 days of receiving your GST notices. You are all compliant once you do this.

Ignoring the notice, however, can lead to severe penalties and strain on your business capital. Treat this as a wake-up call, and make a commitment to remain GST-compliant moving forward.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.